[EN] The Three Elements of Attracting Startup Investment: ‘People,’ ‘T… 2023-04-25

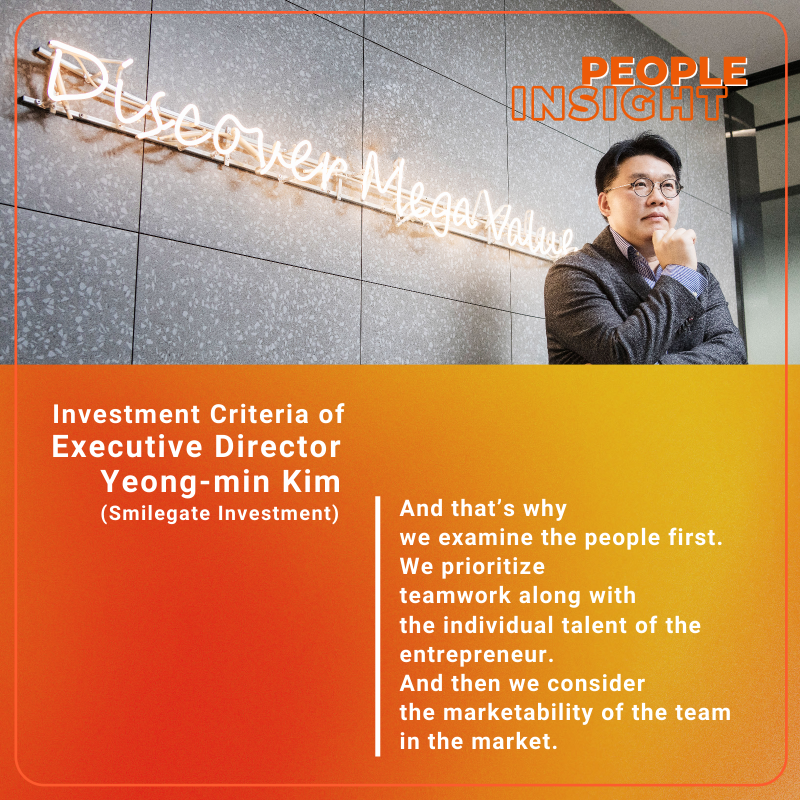

Principles of Startup Investment from Executive Director Yeong-min Kim of the Smilegate Investment Initial Investment Team

Smilegate Investment Executive Director Yeong-min Kim

Smilegate Investment (hereinafter referred to as ‘SIV’) is a venture capital (VC) firm with a vision of building a better future through investment activities based on its ideology, ‘The future is different than the present.’ The company has established a collaborative system with Orange Planet, a non-profit entrepreneurship foundation in Smilegate Group, to generate synergy in the domain of initial startup investment. We met with Executive Director Yeong-min Kim of the SIV Initial Investment Team, who discovers and decides on investing in startups with potential, to listen to his journey as a ’companion to successful startups.’

Q. Please introduce yourself and tell us about the work you do for SIV.

Hello, my name is Yeong-min Kim and I am the executive director in charge of the Initial Investment Team. I mostly work on discovering and investing in startups that are in the very early phases. As of late, the investment industry has been focusing on discovering startups that are in their early phases, being less than three years old. This is because when it comes to startups that are just starting out, we can examine the potential of the company based on its vision. We are starting out together as a startup with potential and an investor. Early startups of course, prefer investment companies with various network connections and experiences.

There is a non-profit entrepreneurship foundation in Smilegate Group, Orange Planet. Orange Planet focuses on supporting and aiding entrepreneurs so they can grow their companies. It runs various programs such as providing office space, mentoring, and investment connections. Naturally, many promising early startups flock to Orange Planet. And this is where it can generate synergy with SIV. SIV makes an investment when a startup under Orange Planet needs to land an investment in its scale-up process. The Initial Investment Team doesn’t just focus on making investments in the gaming industry, which is the core business domain of the parent company, it also makes investments across various sectors including ICT, the environment, bio, and materials/parts/equipment. We have professional reviewers who conduct a wide range of research in their respective domains and discover startups by searching for diamonds in the rough (smiles).

Q. How do you collaborate specifically with Orange Planet, the entrepreneurship aid foundation within the Smilegate Group?

Many of the companies aided by Orange Planet have grown noticeably, such as Bank Salad. Since most of the companies moving in to Orange Planet or receiving aid from Orange Planet are startups in their very early phases, Smilegate Group thought that it could generate even more synergy if the group also makes investments in addition to discovering and attracting startups, which led to the creation of our Initial Investment Team in Smilegate Investment. In the latest regular recruitment by Orange Planet, over 400 teams applied and the SIV Initial Investment Team participated in the process of startup selection involving documentation review and interviews. We have also been mentoring the teams selected through the regular recruitment process so they can be selected for large government-funded projects such as the TIPS program in the future.

Q. SIV has been gaining attention in the startup scene as of late. What kind of differentiation does it offer as an investment company?

SIV is a VC with a history and tradition of investing in 600 companies over the course of 20 years. In other words, we have competitiveness from gaining many insights as we continued to grow as a business. In addition, SIV is different from other VCs because it can establish a collaborative system with the Smilegate Group, which has emerged as a global IP powerhouse, and coordinate with the various organizations within the group. More specifically, we can generate investment synergy in various ways, such as by establishing connections for partnerships overseas and attracting follow-up investments.

We are responsible for initial investment, but we also have variety and capabilities in terms of human and physical resources that can cover everything from the seed investment within the organization through series A ~ C investments and PE/mezzanine funding. We have over 20 investment reviewers with expertise across their respective industrial domains, including bio and the environment/energy, along with the operating assets of 1.2 trillion won.

As I said earlier, we are mentoring entrepreneurs who have joined the Orange Planet ecosystem in business strategies, developing technology, and attracting investments at no charge, and I think we are making an impact (social value) in developing the leading entrepreneurs of the next generation.

Q. We have been hearing quite a lot about how the ‘investment market has shrunk’ as of late. What kind of changes are there in the investment atmosphere of SIV?

With interest rising and the economy on the downturn, startups that have reached the phase where they need large investments are being affected. And I imagine that among unlisted companies, large companies and companies that were soon to be listed on the stock market took quite a hit during this time. But if they could survive through this period, I think they have a great chance at succeeding in the long term. For startups in their very early phases, this could be a better opportunity. If you can seize opportunities in a market that has shrunk, that in itself can serve as competitiveness for the company. What’s encouraging is that SIV’s parent company, Smilegate Group, is actively supporting investing so we can continue to make investments regardless of the current investment market situation.

Q. Where do you focus when it comes to assessing the value of a company as an investor? What is your investment criteria?

Every investor has a different perspective when it comes to which companies they invest in. How much the startup has grown is also something to consider. When it comes to companies that are soon to be listed or are growing after landing some investments, we mainly examine their ‘numbers,’ or their specific performance. But it’s different for early startups. They don’t have any numbers, nor any clarity in the services they can provide. So we examine the people first. We prioritize examining the teamwork along with the individual talent of the entrepreneur. And furthermore, we consider the marketability of the team in the market. This is because no matter how many talented people get together, if their marketability is weak or if the market size is too small, their growth will be limited.

From the teamwork aspect, we prefer co-founders. Most company CEOs or presidents refrain from co-founding due to the equity structure, but from the investor’s perspective, it is better in terms of risk management for a company to be founded together than alone. And rather than having an equity structure where the co-founders all have the same equity, it would be better to establish a structure where there is one final decision-making authority.

Q. You said that the ‘people’ are important as an investor when it comes to evaluating the company. What would be some of the virtues that a good entrepreneur should possess?

Most people who attempt entrepreneurship possess outstanding experience, capabilities, and entrepreneurship abilities. This is just my opinion based on personal experiences, but there are some factors shared by successful businessmen. The most common factor is leadership. Assessment of a person’s leadership will come from the people around them, but it is difficult to receive positive assessment of one’s leadership skills overall. In the end, leadership is proven by performance. In addition, even if someone receive positive assessment in terms of technology, their assessment on business management could tell a different story. Therefore, they need leadership along with an open mind and human resource capabilities. They need to develop an optimal combination of team members each with their own respective strengths, and this is where you can see the talent of the CEO. This is because even if the decisions are not perfect, it is even more important to be decisive and act quickly in a startup. This means that they need to be decisive.

Q. According to the ‘Startup Trend Report 2022’ published by Startup Alliance, the overall startup ecosystem atmosphere was evaluated as a mere 53.7 out of 100 points. This value directly reflects the rather grim outlook in the market, with reduced investments and an economic recession. What kind of strategy should a startup employ to survive in this market on a downturn?

Q. Lastly, what do you think about the investment market this year? Are there any trends that we should be on the lookout for among the entrepreneurship trends in 2023?

* People Insight

People Insight is a corner that introduces people with insight into the corporate culture of Smilegate Group, which prioritizes creativity and originality. We can re-think the value and significance of creativity and originality pursued by Smilegate Group through the various experiences and knowledge shared by the people introduced in People Insight.

TOP

TOP